Best way to save money on gas how to save money on gas how to save gas money tips on how to save gas how to get cheaper gas how to get gas for cheap cheaper gas and electricity deals cheaper gas and electric for disabled

Cheaper Gas: Quick Tips to Save Money at the Pump

What's happening

Gas prices have dropped from record-high levels but are still much higher than last year.

Why it matters

With prices so high, using less gas and paying less for fuel can add up to sizable savings.

Gas prices have retreated from their record high of $5.02 a gallon on June 16, but they're still 9% higher on average than last year at this time -- that's about $11 more to fill up a 15-gallon tank.

Fluctuating oil production and the war in Ukraine are contributing to higher prices at the pump. And while there's not much that individual motorists can do about those factors, there are several ways to save money on gas.

Read on for details on price trackers, tips for improved fuel efficiency, club memberships and more.

Track local prices

GasBuddy is a well-known website for tracking gas prices in the US and Canada. It also provides data for the US Office of Energy Efficiency & Renewable Energy's gas tracker pages. The sites present the information in different ways -- try them both to see which you prefer. GasBuddy is available on the web or via mobile apps for Android and iOS, although critics have raised concerns about its data tracking and privacy policies.

Geico also provides a helpful local gas station tracker: Enter an address, city or ZIP code plus a maximum distance area, and Geico will return a detailed list and map with regular, midgrade and premium gas prices as well as directions to stations.

AAA provides a gas price tracker in its mobile app (Android, iOS), as does Gas Guru (Android, iOS), and you can check gas prices in your vicinity when using navigation apps like Waze and Google Maps.

Get money back from gas cards and fuel rewards programs

Major gas stations typically offer credit cards and reward programs that give you a percentage back. Speedy Rewards offers a $25 gift card when you reach 500 points, or 50 gallons of gas. At $5 a gallon, that's 10% back on your gas spending.

Shell and BP claim you'll save at least 5 cents per gallon with their respective reward programs, and ExxonMobil says you'll get at least 3 cents off. Be sure to review the terms of each program to see exactly what percentage of your gas spending you'll be getting back.

Supermarket chains also offer rewards programs: For every $100 you spend on groceries at Safeway or Kroger for example, you'll get 10 cents off gasoline the next time you fill up. Kroger works with Shell and Kroger Fuel Centers, while Safeway's program works at Chevron, Texaco and Safeway stations.

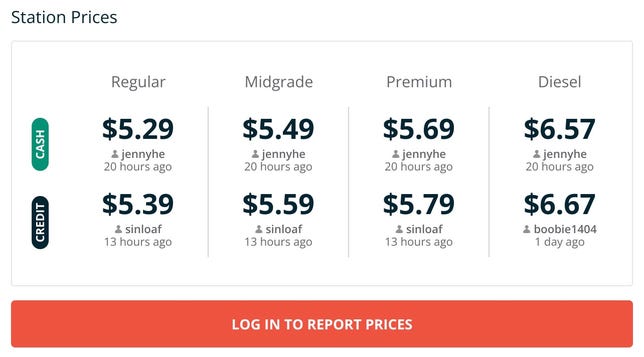

Pay for gas with cash

GasBuddy shows both credit and cash prices if there is a difference.

Screenshot by Peter Butler/CNETThe practice of charging less for gasoline for customers paying cash varies by region and individual gas station: In Los Angeles, several gas stations offer 20-cent discounts for cash, especially for premium gas.

That difference can quickly add up: You could save $3 every time you completely fill a 15-gallon tank, or $156 a year if you top off weekly. (Just watch those ATM fees: If you're paying $2 to $3 to get your cash each time, you could be losing money.)

Check your tire pressure

Making sure your tires are properly inflated can boost gas mileage by 3%, according to the US Department of Energy. At current prices, that could save you about 15 cents per gallon.

But 60% of car owners only check their tire pressure if an indicator light turns on, according to Jiffy Lube's Vehicle Maintenance Survey. A tire pressure gauge can monitor the health of your tires and only costs about $10 to $20.

When tires wear down to a depth of 1/16th of an inch, they're considered "bald" and should be replaced right away.

Google Maps will recommend routes designed to save gas.

Screenshot by Cliff Colby/CNETMap your route

Google Maps can also boost your miles per gallon by recommending certain routes that avoid hills and traffic, resulting ideally in more constant driving speeds. Fuel-efficient routes are available on the mobile Android and iOS apps, though the feature hasn't been rolled out to all users yet.

To turn on fuel efficiency in Google Maps, tap the three dots on the directions screen, then tap "Route options" and toggle the "Prefer fuel-efficient routes" option on.

Other fuel-tracking mobile apps like Fuelio and JerryCan suggest methods of improving your fuel efficiency as well as tracking gas prices at stations. JerryCan claims that drivers using its app can improve their fuel efficiency by up to 20%.

Try a club membership for discounted gas prices

Costco, Sam's Club and Walmart Plus all offer discounted gas prices to members. Walmart Plus charges 5 cents less at its fueling centers, plus access to all Sam's Club locations. Memberships cost $13 a month or $98 a year, while Sam's Club memberships range between $45 and $100 per year.

Costco fuel prices are almost always significantly lower than at traditional gas stations, generally about five to 25 cents, according to Consumer Reports. Its June 10 review of gas prices found a 34-cent discount on Costco gas in Independence, Missouri, compared to the closest commercial gas station. Costco memberships cost between $60 and $120 per year.

Warning: Due to the record-high prices nationally, gas lines at Costco have become notoriously long.

Buy discounted gas cards through resellers

Gift cards are a popular choice for easy presents, but as you might expect, not all of those gift cards get used. A variety of resellers let consumers hock their unused gift cards or buy them on the cheap.

Raise and Gift Card Granny are two sites that let users buy and sell unused gift cards from Chevon, Texaco, Shell, BP and other gas providers. As you might guess, most discounted gas gift cards are sold out right now, but you can set up alerts for when new ones come in.

Be careful to check the actual price discount and other specifics of any card -- both sites also sell gift cards at retail rates, and Gift Card Granny also sells reward cards.

Become a master of fuel efficiency

You can ease gas consumption quite a bit by learning basic fuel-efficiency practices. Advice for saving gas while driving abounds on the internet, and AAA has compiled some great tips. Here are a few of the biggest savers:

- Drive the speed limit, especially on the freeway. Fuel economy drops sharply once you start driving faster than 50 mph.

- Ease up on the acceleration. "Jackrabbit starts" -- when a car lurches forward very quickly -- are a major gas waster. Accelerating smoothly will also let automatic transmissions shift to higher gears earlier, saving more fuel.

- Avoid extended idling. You're going nowhere while burning up your gas. If it's going to be longer than 60 seconds, turn off your engine.

- Minimize air conditioning. Even at high speeds, open windows hurt your fuel efficiency less than air conditioning. Park in the shade or use a windshield screen to keep your car as cool as possible in summer.

- While driving in the city, time traffic lights so that you don't need to stop and start. Similarly, take your foot off the gas as soon as you see a red light or near a stop sign. The less braking and accelerating, the more gas you will save.

Go even further with hypermiling

Hypermiling is the practice of maximizing fuel efficiency to the ultimate degree, from choosing routes that require less braking and accelerating to cleaning out your trunk to lower your vehicle's weight.

Hypermilers might even park facing the sun when it's cold to conserve energy spent defrosting their windshield, and in the shade when it's cool to save on AC.

In the video below, CNET's Brian Cooley explains how drivers can adapt extreme hypermiling techniques to increase their own fuel efficiency.

Consider bicycles, public transit and electric vehicles

Soaring gas prices provide a timely opportunity to wean yourself off gasoline-based transportation. Riding a bike or using public transit more often will obviously help decrease your gasoline costs.

Similarly, if you can afford an electric vehicle it will certainly reduce your gas usage. It's not just Tesla -- Hyundai, Ford, Porsche, Audi and many other automakers sell electric cars. Bonus: You'll be fighting pollution and climate change at the same time as you're saving money.

Check out CNET Cars' list of the best electric vehicles to learn about the latest and greatest EV cars.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

Source