How to set up a vpn on your smart tv 5 easy methods to put how to set up a vpn on your smart tv 5 easy chuck how to set up a vpn on your smart tv 5 easy dessert how to set up vpn in windows 10 how to set up a vpn on android how to set up a vpn tunnel how to set up a vpn on a mac how to set up a go fund me page how to set up a chess board how to set up venmo how to set up voicemail on iphone how to set a mouse trap

How to Set Up a VPN on Your Smart TV: 5 Easy Methods

Most smart TVs aren't compatible with virtual private networks right out of the box, but pretty much any smart TV can be hooked up to a VPN. Even if your TV isn't of the smart variety, you may still be able to use a VPN on it -- as long as you have the right equipment.

One of the two big reasons why you may want to hook a VPN up to your smart TV is if you want to stream geographically restricted content. The other is if you want to keep your TV watching activities private and effectively hidden from your internet service provider.

There are a couple of different ways you can go about setting up your VPN to work with your TV. But which route you choose to take will depend on your personal preference, technical know-how, budget and what equipment you have on hand. We'll show you some of the ways you can set a VPN up on a TV and highlight why you would want to do so.

Why use a VPN on a TV?

Today's TVs aren't just for watching local network programming or cable TV. They're also for streaming video on demand from your go-to streaming providers.

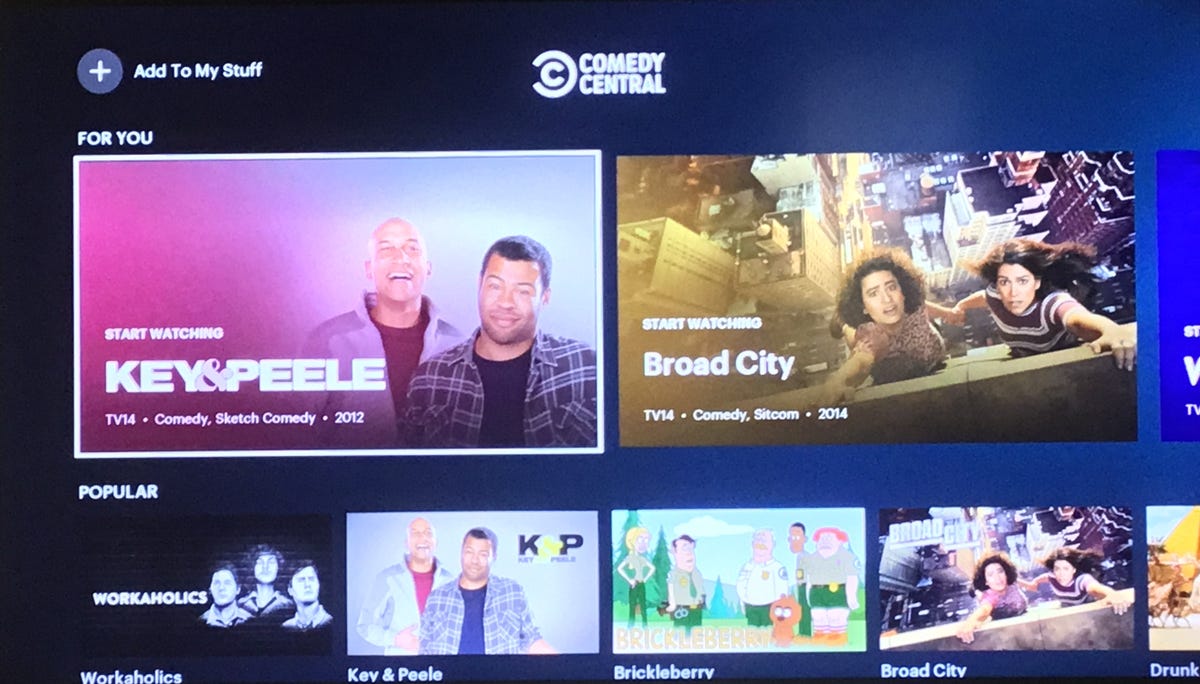

The amount of streaming content available today might seem limitless already, but some content is regionally locked. If you're itching for more, or if the programming you want to watch isn't available in your country, you can use a VPN on your smart TV to spoof your location to access virtually any of the content you may want.

If, say, you're in the UK but you want to stream programming that's only available in the US, then you can hook your VPN up to your smart TV and connect to a server in the US. Since the VPN changes your IP address to a US IP address in the process, the streaming service you're visiting will assume you're in the US and serve up American programming, even if you're across the Atlantic. Just make sure to check with your streaming service of choice to confirm that using a VPN doesn't violate its terms of service. You don't want to risk losing access to your streaming account for any reason.

Even if unblocking geo-restricted video content on your smart TV isn't of particular interest to you, you may want to use a VPN on your TV as a way of preventing your ISP from being able to monitor your viewing habits or keep track of the internet activity being generated by your smart TV.

When you connect to a VPN, you establish an encrypted connection between your device and the internet via a VPN server in a remote location. This means that all of the internet traffic you're transmitting through that encrypted VPN connection is hidden from any entity with an intent to monitor your activity, including your ISP. When you hook up a VPN to your TV and connect to a VPN server, your ISP won't be able to see what you're watching or otherwise decipher any of the internet activity transmitted or received by your TV.

How to set up a VPN on a smart TV

Like any software or service, your first step here is to work backward from what's available for your operating system. The most VPN-friendly smart TV OSes are Amazon Fire TV and Google's Android TV and Google TV platforms. That said, if you use Roku, Apple TV or the built-in operating systems for Samsung, Vizio, LG or any other platform, you still have options.

Here are a few of the most practical ways you can go about hooking up a VPN to your smart TV.

If you have Fire TV

If you have one of Amazon's new Fire TVs, you'll be able to download your VPN directly to your TV, provided your VPN offers a Fire TV app. Not all VPNs offer compatibility with Amazon Fire devices, so you'll need to pick one that does if you decide to go this route. The VPNs we recommend that are compatible with Amazon Fire devices include Surfshark, NordVPN and ExpressVPN. If you don't already subscribe to one of those VPN providers, then go ahead and sign up and download the provider's app from the Amazon Appstore. (All three offer a 30-day money-back guarantee, so you can try each one risk-free to see which one works best for you).

Once you've downloaded the app and signed into your VPN account through your Amazon Fire TV, you can connect to a VPN server. As long as you're connected to the VPN on your Fire TV, you can unblock streaming content and hide your viewing habits from your ISP.

If you have an Android/Google TV

Similarly, if your smart TV runs on Google's Android operating system, then you can set up a VPN on your TV by simply downloading your VPN's app from the Play Store directly onto your TV. And even though Google is in the midst of rebranding Android TV as it transitions to a slicker, more user-friendly platform in Google TV, you'll still be able to access Android apps in the Play Store after you've upgraded to Google TV since it still runs Android under the hood.

What you'll need to do first is to get a VPN that works on Android, if you don't have one already. Then, navigate over to the Play Store on your Google TV, search for your VPN provider's app and download it. Once you've downloaded the VPN app to your TV, sign in and connect to a VPN server.

If you want to unblock US-only content, then you'll need to connect to a VPN server in the US, or to a server in the UK for UK-only content, and so on. If all you want to do is protect your TV watching privacy and prevent your ISP or other entities from monitoring your viewing activity, then we'd recommend connecting to a VPN server closest to your physical location, in order to achieve optimal connection speeds through your VPN.

The potentially more difficult (and more expensive) way

If your TV doesn't run on the Android operating system, then one of the ways you can set up a VPN on your smart TV is by running a VPN connection through a router. But proceed with caution. Not all routers support VPN connections, so if you don't already have one, you'll need to purchase a compatible router -- which can get pricey if you want a router that can handle the VPN connection and deliver a smooth streaming experience. Also, installing a VPN on your router (even if it is compatible) won't necessarily be plug-and-play, and you risk ruining your router or voiding its warranty if you botch the installation process.

Fortunately, the best VPN providers on the market do offer step-by-step instructions for router installations for a variety of VPN-compatible router models in their help sections and have support staff on hand to help you. So you don't have to go it alone completely, but the process still isn't entirely risk-free. If you don't want to complete the install yourself, some VPNs, through a company called FlashRouters, are happy to sell you routers with VPN compatibility already preinstalled on them. This could be the way to go if you don't want to risk installing it yourself, but keep in mind that you'll be paying a premium of probably about $100 to $150 over and above retail for your preconfigured VPN router.

So, once you've got your VPN successfully installed on your router and configured it with the servers you intend to use, you can go ahead and connect to a VPN server through your router firmware's dashboard. You'll want to make sure your TV is connected to your VPN router to ensure it's using the VPN connection and you're able to unblock the content you want and keep your TV viewing activity private.

See also: The Pros and Cons of Using a VPN on a Router

The resourceful way

If you don't have a Google TV or a VPN-compatible router, and don't intend to purchase either, you can use the equipment you have on hand to share your VPN connection with your smart TV.

You could accomplish this by running an ethernet cable from your computer to your smart TV. But on top of stringing a long wire from computer to TV, this method may require additional adapters, depending on what kinds of devices you have. Once you've got the connection between your TV and computer established, then connect to a VPN server on your computer and you're all set. The wired connection may not be the most practical solution, but it's an option.

The simplest and most practical way to go about this would be to use your laptop or desktop as a Wi-Fi hotspot and connect your TV to your computer wirelessly.

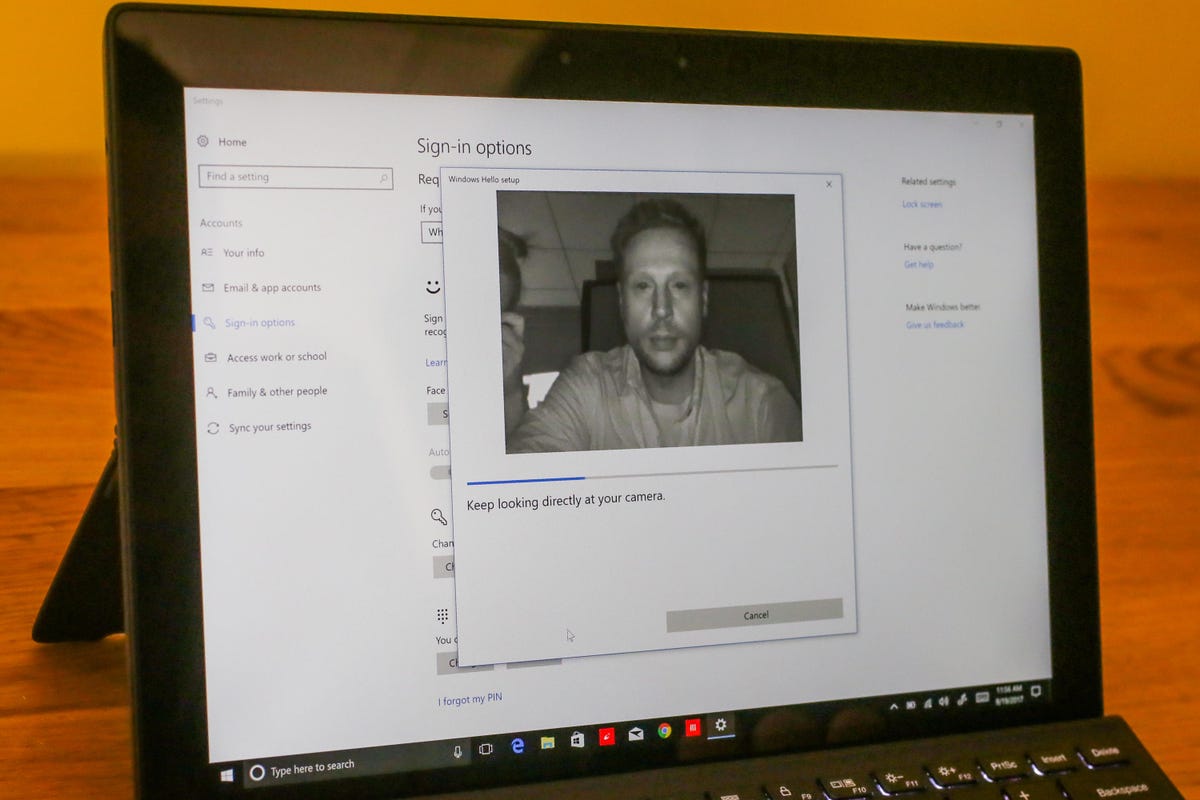

Note that if you're using MacOS, you'll need to manually set up the VPN on your Mac using either the L2TP or IKEv2 VPN protocol and connect your Mac to your router via an ethernet cable to share your VPN connection over Wi-Fi. Your VPN provider will have specific instructions on how to manually set up its service on your Mac.

On Windows:

- Go to Settings -> Network & Internet -> Mobile hotspot

- Click on Edit to set a network name and password for your hotspot

- Select Wi-Fi under Share my internet connection over

- Toggle the Mobile hotspot to the On position under Share my internet connection with other devices

- Connect your smart TV to the hotspot you just created as you would any other Wi-Fi network and connect to your VPN on your PC

On Mac:

- Connect your Mac to your Wi-Fi router using an ethernet cable (use an adapter if your Mac doesn't have an ethernet port)

- Go to System Preferences -> Sharing

- Click on Internet Sharing in the left panel

- Select your VPN connection from the Share your connection from dropdown

- In the To computers using box, check Wi-Fi

- Click on Wi-Fi Options in the bottom-right corner

- Set a network name and password for your hotspot, select WPA2 Personal in the Security field and click OK

- Click on the box next to Internet Sharing in the left panel and click Start in the dialogue box that pops up

- Connect your TV to the Wi-Fi hotspot you just created as you would any other Wi-Fi network and connect to your VPN on your Mac

The 'I don't have a smart TV' way

Even if you don't have a smart TV, you're in luck because you can set a VPN up on it if you're able to connect a streaming device like a Roku, Amazon Firestick or Google Chromecast to the TV. These ingenious little devices essentially turn any TV with an HDMI port into a smart TV, at a much lower cost than an actual smart TV.

Basically, you can use the methods listed above to connect a VPN to your TV -- and if you go with Chromecast with Google TV or Amazon Firestick then you can download the VPN directly via the Play Store or the Amazon Appstore, respectively. The only difference is that you'll use your streaming device's interface to connect to the VPN instead of directly via your TV interface. You'll still get all the privacy and unblocking benefits that a VPN offers if you decide to take this route, but only for content you watch through your streaming device.

Streaming devices like the ones offered by Roku and others can turn your ordinary TV into a smart TV.

Sarah Tew/CNETNext steps

When you're thinking about setting up a VPN on your smart TV, there are a few things to consider. First of all, you'll want a VPN that provides fast speeds that are sufficient in supplying a smooth streaming experience free of buffering. You'll also want to make sure the VPN you select has servers located in the countries you want to unblock content from.

If you have a Google TV and intend to download the VPN app to your TV from the Play Store, then the VPN you go with will need to be Android-compatible. And your VPN will need to be Amazon Fire TV-compatible if you want to run the VPN directly on your Amazon Fire TV.

If you'd rather run the VPN through your router and connect your TV that way, then it's important to make sure your VPN supports router connections and has router setup guides that include your router of choice. It doesn't hurt for your VPN to have helpful, knowledgeable technical support, either, in case you need assistance with your setup.

You'll also want your VPN to provide the privacy protections necessary to keep your viewing habits private and safe from prying eyes.

The VPNs we recommend that fit the bill and check all those boxes include ExpressVPN, Surfshark, and NordVPN. Any of those options will get the job done for your unblocking and privacy needs on your smart TV.

Source