Who Is My Student Loan Servicer? Here's How to Find Out

On Wednesday, President Joe Biden announced his long-awaited student loan forgiveness plan. Borrowers who make less than $125,000 are eligible for cancellation of $10,000 of their federal direct loans, or $20,000 if they are federal Pell Grant recipients.

More than 45 million Americans carry some amount of student loan debt. Close to 8 million borrowers (less than 20%) may be eligible to have their debts wiped automatically, according to the Department of Education.

If you want more details on your specific loan, however, you'll want to contact your loan servicer -- the third-party company contracted by the Department of Education to handle billing and other services.

You may want to reach out, for example, if you made payments during the loan forbearance period and want to request a refund to maximize your debt forgiveness.

Here's how to find out who your loan servicer is, how to contact them and what you should have handy when you reach out.

For more on student debt forgiveness, find out if you're eligible, learn how to sign up and know how to avoid student loan payment scams.

Who is my student loan servicer?

If you don't know who your servicer is, you can sign into your Federal Student Aid account with your FSA ID. Once you get to the dashboard, you'll see your service provider and other loan details.

You can also call the Federal Student Aid Information Center (FSAIC) at 800-433-3243 or consult the Department of Education's "Who is my loan servicer?" site for more information.

How do I contact my student loan servicer?

There are nine companies that manage most federal student loans. The largest is Nelnet, which acquired Great Lakes Education Loan Services in 2018 and is now responsible for overseeing more than 40% of all student loans.

If you know your provider, we've included links and telephone numbers, below, for the companies that service federal student loans.

Student Loan Servicers

| Servicer | Website | Phone Number |

|---|---|---|

| Aidvantage | https://aidvantage.com/ | 800-722-1300 |

| EdFinancial Services (HESC) | https://edfinancial.com/home | 855-337-6884 |

| Educational Computer Systems Incorporated (ECSI) | https://efpls.ed.gov/ | 866-313-3797 |

| FedLoan Servicing (PHEAA) | https://myfedloan.org/ | 800-699-2908 |

| Great Lakes Educational Loan Services | https://mygreatlakes.org/ | 800-236-4300 |

| Maximus | https://maximus.com/fsa | 800-621-3115 |

| Missouri Higher Education Loan Authority (MOHELA) | https://www.mohela.com/ | 888-866-4352 |

| Nelnet | https://www.nelnet.com/welcome | 888-486-4722 |

| Oklahoma Student Loan Authority (OSLA) | https://public.osla.org/ | 866-264-9762 |

Be patient. It might take some time

Biden's announcement has unsurprisingly sparked a massive number of inquiries -- servicer sites are experiencing delays, and providers are also reporting unusually high call volumes.

Redditors on the Student Loans subreddit on Wednesday reported they were on the phone for several hours.

On Thursday morning, Nelnet asked borrowers to "hold off on calling us as we continue to experience heavy phone volume."

Come prepared

When you do reach out, have handy any information you know about your loan before contacting your loan provider, including account numbers and balances. This is especially important if you are going to ask for a refund.

They might not have the answers you need

"We do not have any more details on who is eligible for loan cancellation than what was announced by President Biden," Nelnet tweeted on Thursday.

On Friday, EdFinancial indicated the most up-to-date info was on the Education Department site, tweeting "We have no updates. Loan eligibility has not been shared with servicers."

Aidvantage also recommends consulting the FSA website.

Get ready for major changes to who services federal student loans

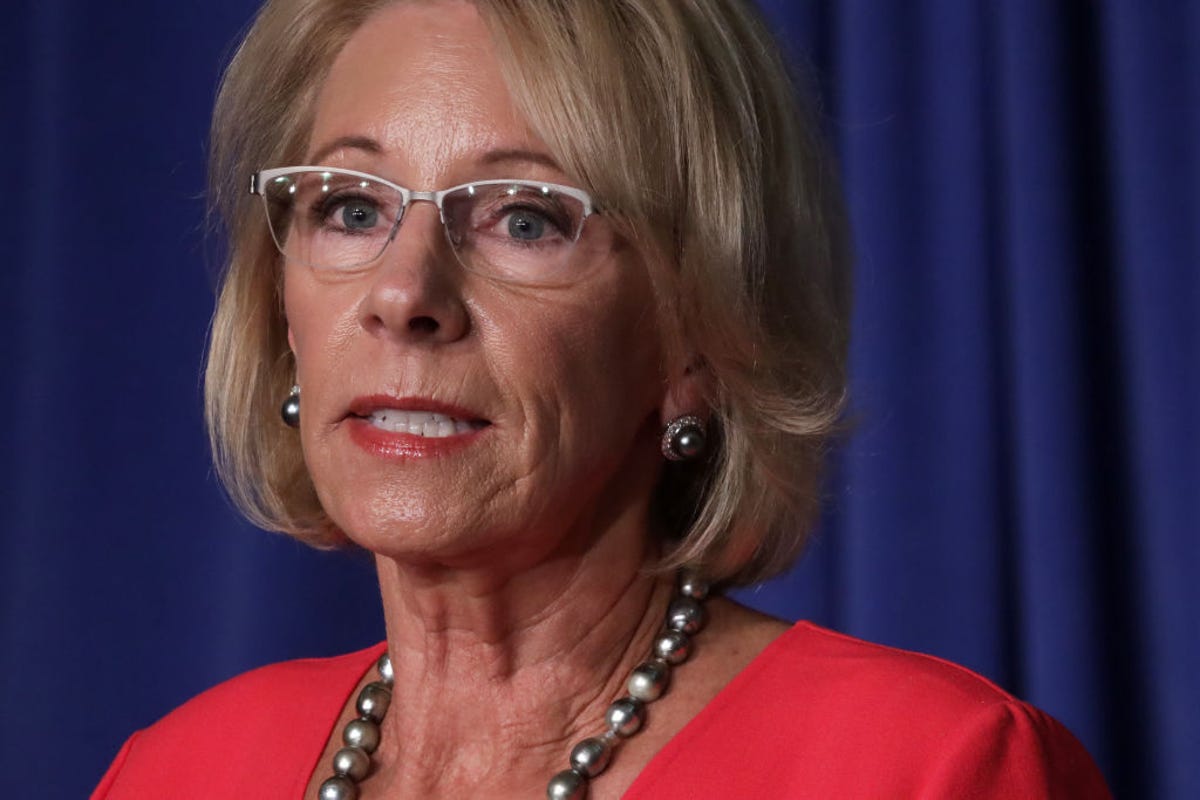

In 2020, US Secretary of Education Betsy DeVos announced a shakeup to the companies contracted to manage student loan payments.

Alex Wong/Getty ImagesIn June 2020, then-Education Secretary Betsy DeVos announced sweeping changes to the companies that would be managing active and defaulted student loans for the federal government to streamline the process and improve a system that "can lead to customer confusion and inconsistent operations."

The number of third-party contractors with contracts from the Department of Education was trimmed from nine to five: EdFinancial Services, F.H. Cann & Associates, Maximus (which runs Aidvantage), MOHELA and Trellis Company.

Aidvantage recently began taking over the 6 million borrower accounts previously overseen by Navient, which announced it was getting out of the federal student loan business last September.

After December 2022, FedLoan Servicing will no longer continue its contract with the government, and accounts are already moving to MOHELA. Some non-Public Service Loan Forgiveness (PSLF) accounts have been moved from FedLoan to Nelnet.

But DeVos also announced that Nelnet and its subsidiary, Great Lakes, would no longer manage student loans for the federal government. The company's contract was initially set to expire in December 2022, but the Department of Education under Biden extended it through Dec. 14, 2023, the Lincoln Journal-Star reported.

Borrowers should receive a letter or email if their assigned servicer has been changed. Your account information should transfer automatically, with no change to the terms of your loan.

If you are told of a change, however, it might be worth checking in with your new provider.

Source